Can the central bank exercise the power to remove directors?

The regulation of Bangladesh Bank has been further enhanced in the amended Bank Companies Act. What the regulatory body does now remains to be seen.

Bangladesh Bank is empowered to remove government nominated directors in state-owned banks. For so long this power was only in the hands of the government. And Bangladesh Bank could only submit a report to the government about the conduct of the directors.

The amended Bank Companies Act also empowers Bangladesh Bank to remove the directors of state-owned and government-owned banks as well as private banks. This has increased the supervisory power of the regulatory body over such banks. As a result, the central bank’s control over the banking sector increased. The people involved in the sector think that the extent to which Bangladesh Bank implements this law is a matter to be seen.

When asked about this, former Central Bank Governor Salehuddin Ahmed told Prothom Alo , ‘It is a good initiative. However, it has to be seen how much the central bank exercises this power. Sharia banks are all private sector. I heard about so many irregularities in these banks, but I did not hear that anyone was removed. However, the central bank has unlimited power in this regard. During my time I had no hesitation in removing the Chairman, MDs. It was not a matter of seeking anyone’s permission or looking to anyone’s decision. Although this opportunity was given in the law, overall the amendment was not good. Because the term of directors has been extended, defaulters have also been given the opportunity to take loans.

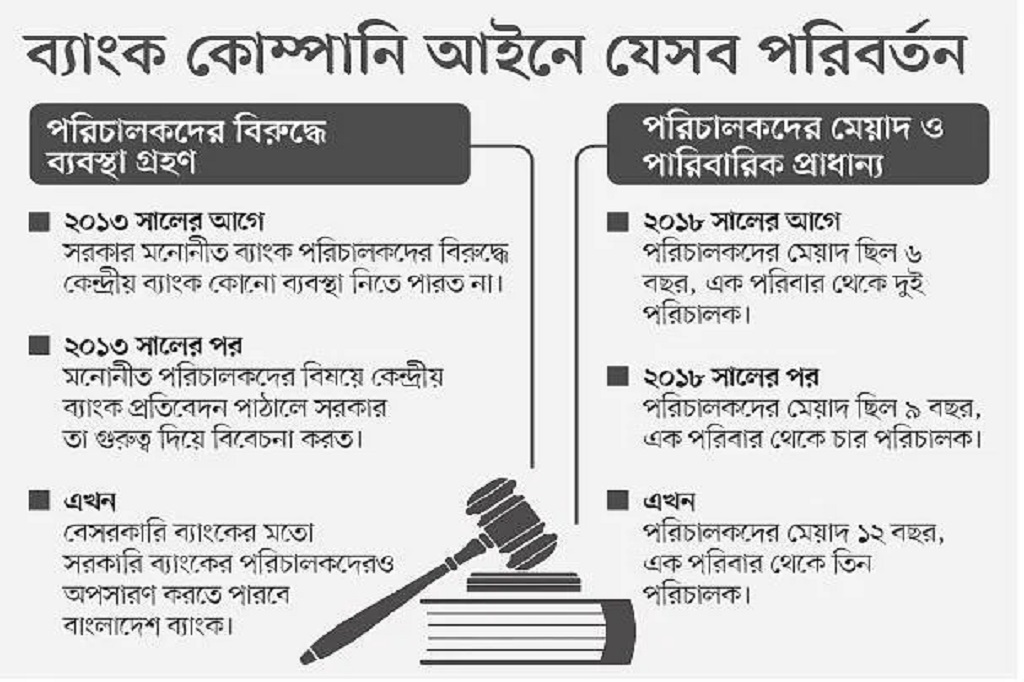

The amendment to the Bank Company Act was passed in the National Parliament on June 26. In this, various changes were made including increasing the tenure of directors from 9 years to 12 years and also providing opportunity to defaulters to take loans. As a result of the amendment, the Central Bank has been empowered to remove the directors of state-owned Sonali, Agrani, Janata, Rupali, Basic and Bangladesh Development Bank (BDBL) as well as the public sector Bangladesh Krishi Bank (BKB), Rajshahi Krishi Unnayan Bank (Rakab) and Pravasi Kalyan Bank. Along with this, this clause will also apply to some directors of private sector IFIC Bank. Because the government owns 32.75 percent shares of IFIC Bank. The government appoints directors in the bank in proportion to the shares.

The law has changed

According to the previous Bank Companies Act, Bangladesh Bank could remove bank chairmen, directors and managing directors (MDs) to prevent them from misusing bank funds or financing money laundering and terrorist activities through transactions harmful to depositors or related to their own interests. However, this rule was not applicable in the case of chairman and director appointed or appointed by the government. In 2013, when the law was amended, it was added that the government will consider it seriously if Bangladesh Bank submits a report on the conduct of bank directors appointed or appointed by the government.

Bangladesh Bank has been given full power to remove the directors of all banks irrespective of public and private in case of irregularities in the amended Banking Company Act in Parliament last month.

In this regard, the spokesperson of Bangladesh Bank Mejbaul Haque told Prothom Alo that this change in the law will allow government banks to play a more important role in ensuring good governance. Public sector bank managers will also be held accountable, which will be good for the entire banking sector.

Incidentally, coordinators and observers appointed by Bangladesh Bank are currently working to improve the financial condition of most of the public sector banks.

The government did not listen to the recommendation

The earlier Bank Companies Act stated that Bangladesh Bank will take the report seriously if it submits a report to the government about the conduct of bank managers nominated or appointed by the government. But in most cases the government did not listen to the central bank’s recommendations. For example, when irregularities started in Basic Bank, Bangladesh Bank pointed it out several times, the chairman of the institution, Submits report to Govt on role of Director and Managing Director (MD). But instead of taking that report into consideration, Sheikh Abdul Hai alias Bachchu was made the chairman of the bank in the second phase. After sending more reports, he was given an opportunity to resign without being removed the day before the end of the term. Sheikh Abdul Hai submitted his resignation letter to the then finance minister’s residence in Iskaton, Dhaka. After 9 years of that incident, the Anti-Corruption Commission (ACC) filed a chargesheet against him last June. However, Bangladesh Bank removed the bank’s MD Kazi Fakhrul Islam at that time.

Meanwhile, Bangladesh Bank sent a report to take action against the former MD of Agrani Bank, Syed Abdul Hamid, but the government did not listen to it. On the contrary, the Financial Institutions Department of the Ministry of Finance extended the term of Syed Abdul Hamid in violation of the law. The extension letter issued in violation of the law reads, ‘The proposal to extend the tenure of Syed Abdul Hamid as MD of Agrani Bank for the next one year has been approved. In this case, there is no need to take the approval of Bangladesh Bank. However, according to the Bank Companies Act, there is no opportunity to appoint and extend the tenure of MD without the approval of Bangladesh Bank.

Again, despite the central bank submitting multiple reports against the former MD of Janata Bank, Abduch Salam Azad, he was repeatedly given the opportunity to stay in office for up to 65 years. But during his tenure, the bank fell into the biggest crisis. The bank that was once known as a good bank is still leaning. About 10,000 crores of Janata Bank is stuck with Anontex and Crescent. The bank has become a hostage to such big groups.

Who is made director?

Most of the people whom the government appoints as directors in banks are former bureaucrats. However, the current bureaucrats are also the representatives of the government in various banks as directors. But over the years, professional accountants, former bankers, university teachers, former judges have also been appointed as directors, who are able to play a good role in the board. On the other hand, most of the former and current bureaucrats do not play a role except for taking allowances and transportation facilities by attending the meeting, said the concerned bank officials.

Co-editor of Awami League’s International Affairs Committee KMN Manjurul Haque alias Lablu was the candidate of the party from Gopalganj-1 constituency. But failed to get nomination. Then on September 9, 2019, this former Chhatra League leader was appointed as the director of Agrani Bank. Before this he was also the director of Agrani Bank.

Rajeev Parvez, co-editor of Awami League’s central finance and planning sub-committee, was the candidate for the party’s nomination from Patuakhali-1 seat in the 11th national election held in 2018. On March 22, 2020, the government appointed him as the director of the state-owned Basic Bank. Then the period was extended again. He was introduced as the Founder and Executive Director of the ‘Governance Policy Explore Centre’ while being made Director.

Bank directors get an allowance of Tk 8,000 for attending each meeting. However, after deducting the tax, he received 7 thousand 200 taka. Some banks hold four meetings a month. Besides the board of the bank, the directors are also members of various committees. Additional money is also paid for participating in these committee meetings.